Monthly Market Report

Market Trends Since 2021

Buyers vs. Sellers Market

Is it still a seller’s market? This is a question I've been hearing a lot lately about the real estate market in Maryland. To correctly answer this question, we have to study the current data.

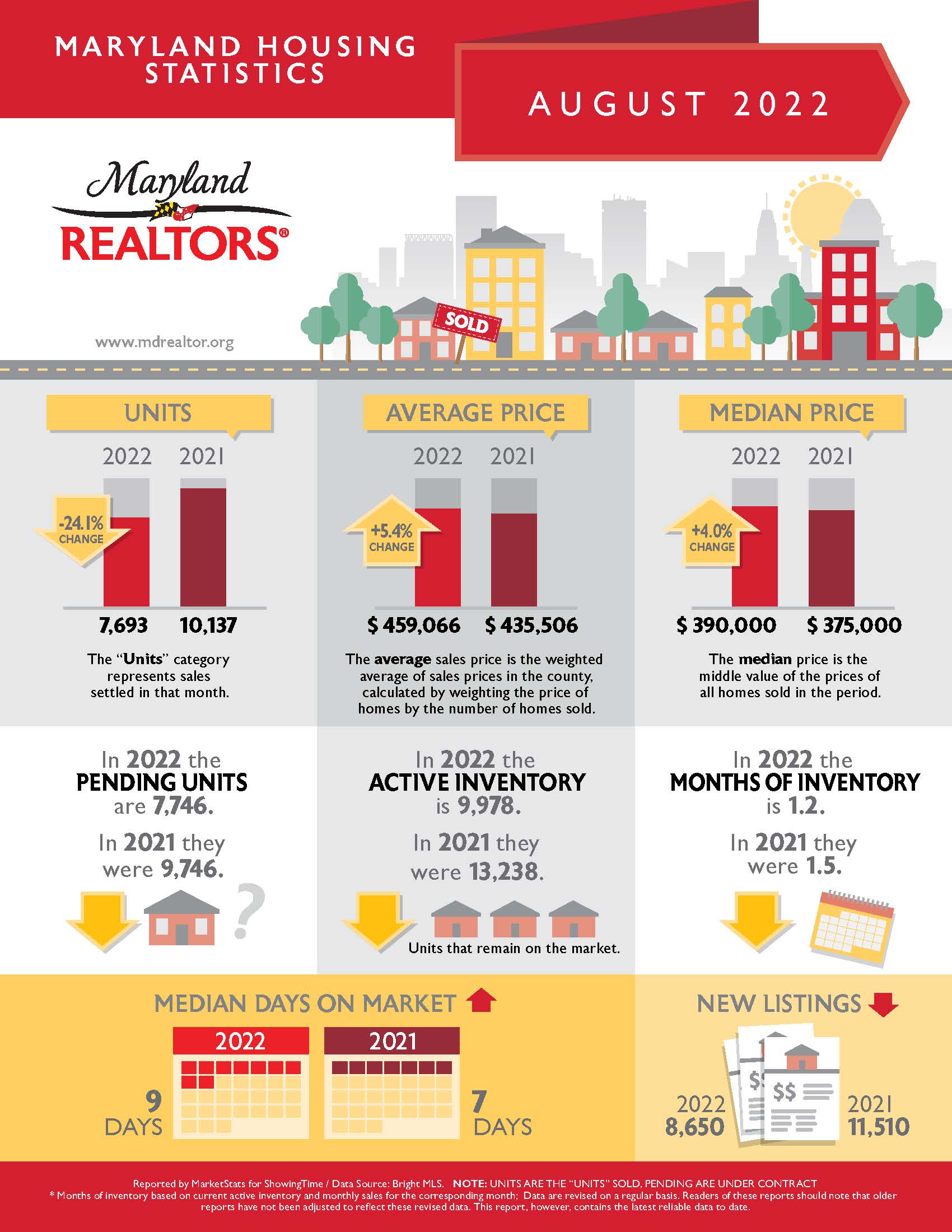

Compared to 2021, The Maryland Realtors August 2022 Housing Statistics show the number of homes sold has decreased by 24%, but prices have still increased by 5%. Meaning, the number of buyers has decreased drastically, but sellers are still increasing real estate prices. Homes are sitting for about two days longer on the market, the number of new listings has decreased by 2,890, and the number of active listings has decreased by 3,260. This data shows there are less people buying and selling homes this year. Even with the real estate market transitioning in Maryland, with home prices still increasing and decreased inventory…it’s safe to say it’s still a seller’s market.

How Inflation Factors In

In 2020-2021 the real estate market shifted to an extreme seller’s market. The pandemic caused housing inventory to drop extremely low due to sellers deciding to stay in their homes, causing the pool of buyers to grow larger and larger. At the same time mortgage loan interest rates dropped drastically causing more buyers wanting to take advantage. More sellers also wanted to take advantage of the pandemic low interest rates, but had a hard time finding another home to purchase due to low inventory.

In 2022, we started to see the market shift again due to inflation. Mortgage rates, gas, and groceries have all seen major increases. According to

AAA, the average cost of a premium gallon of gas in Maryland is $4.25; which compares to the $3.79 average last year. According to

Keeping Current Matters, this year’s mortgage rates exceeded 6% for the first time in over a decade. Last year’s mortgage rates were closer to 3%. This recent hike in rates has caused many buyers in Maryland who were excited to begin the home buying process last year to back out of the process this year due to the lack of affordable housing. Experts are expecting mortgage rates to lower and stabilize again by the end of 2023. Living in an era of unpredictability, I’m interested to see how the real estate market will look like around this time next year.