Maryland Market Report

Comparing Maryland Housing Market Trends

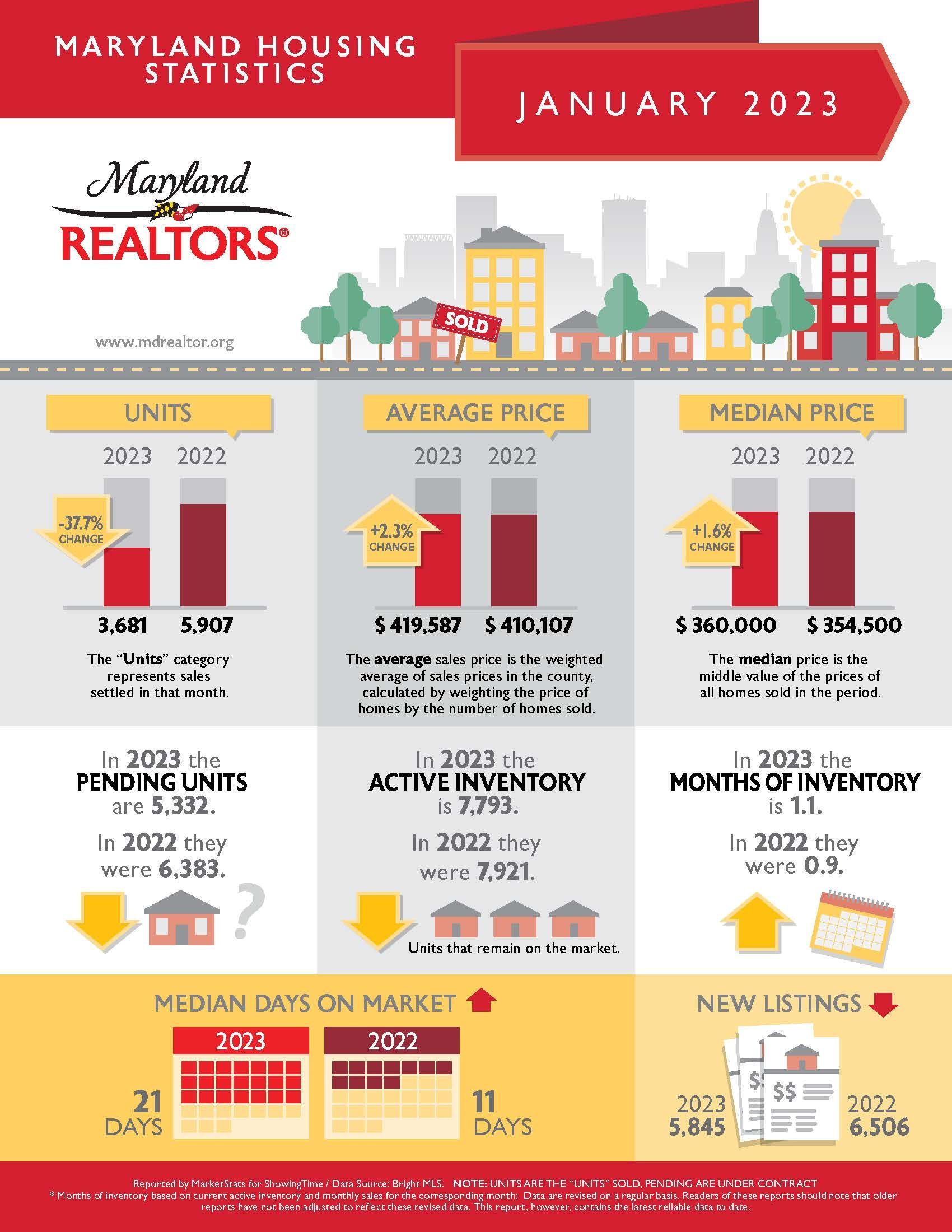

Units Sold

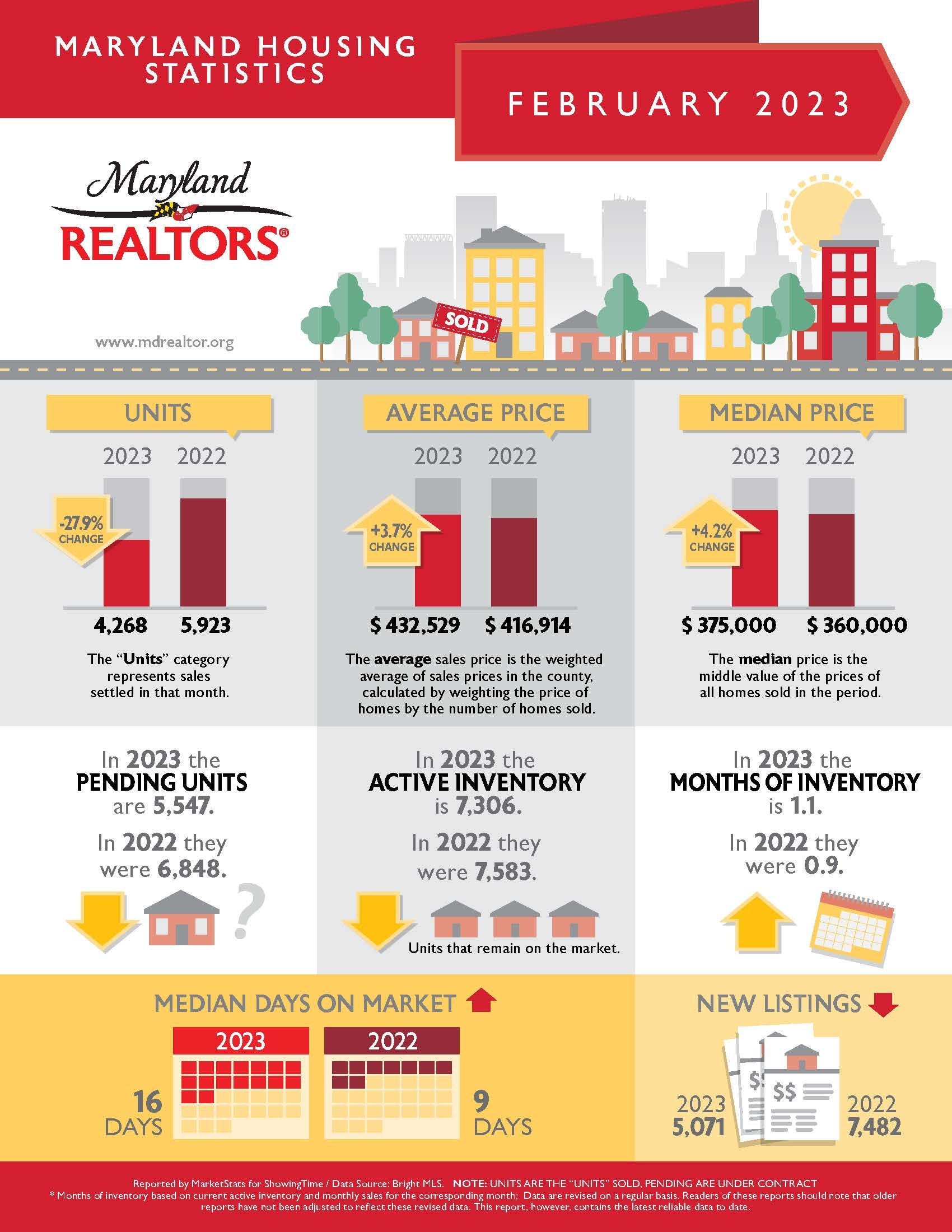

The spring real estate market is beginning to ramp up! According to the Maryland Realtors Housing Statistics, there were 4,268 residential and commercial units sold in February 2023. This shows an increase of 587 units sold compared to January 2023. If you’re planning to buy a home this season, this is the perfect time to get pre-approved and begin searching before things start to pick up even more in late spring.

This data also shows a decrease of about 28%, 1,655 units, compared to the number of units sold in February 2022. Even though this is a noticeable difference compared to last year; it’s very understandable considering the effects of the pandemic, and the ups and downs of nationwide inflation and mortgage rates. With the economy stabilizing, more buyers are beginning to re-enter the market.

Months of Inventory

According to

Maryland Realtors Housing Statistics, there’s currently 1.1 month’s worth of available MD housing inventory. The amount of Maryland’s housing market inventory remained the same from January to February of this year. This means the buyers who’ve closed on homes within the last month have had to choose from existing inventory. New inventory may be getting ready to hit the market as sellers prepare to list in the spring.

This current data also shows a 20% increase from the 0.9 month’s worth of MD housing inventory in February 2022. Proving the housing market is slowly but surely continuing to stabilize from the effects of the COVID-19 pandemic.

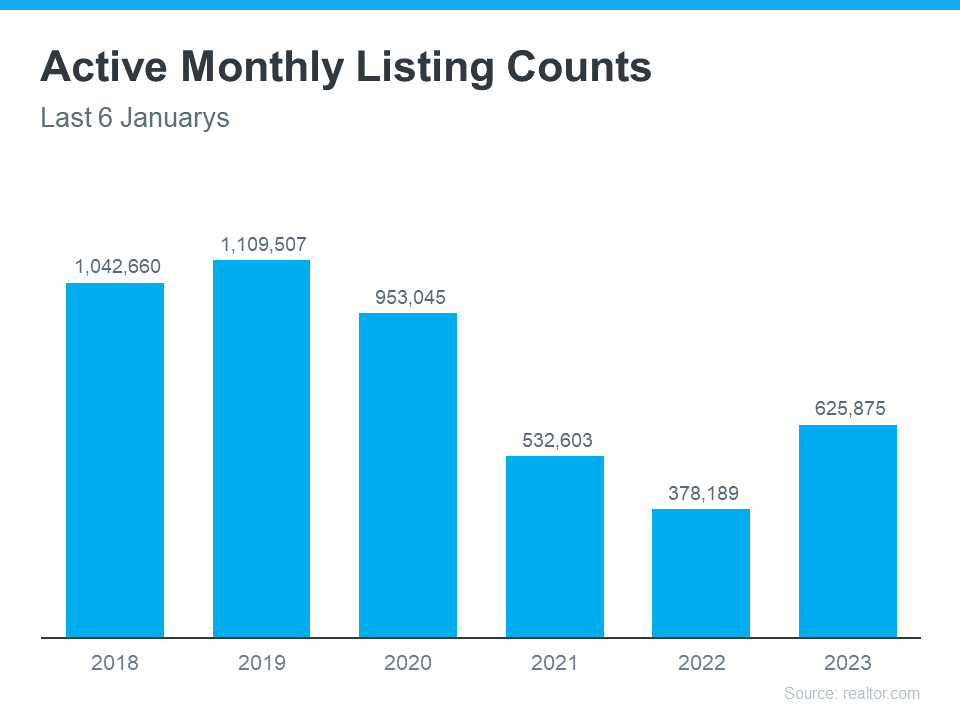

According to the latest Monthly Housing Market Trends Report from realtor.com:

“There were 65.5% more homes for sale in January compared to the same time in 2022. This means that there were 248,000 more homes available to buy this past month compared to one year ago. While the number of homes for sale is increasing, it is still 43.2% lower than it was before the pandemic in 2017 to 2019. This means that there are still fewer homes available to buy on a typical day than there were a few years ago.”

The graph below shows how today’s national inventory of homes for sale compares to recent years:

Average Price

The average price of a Maryland home in February 2023 was $432,529; stated by the latest

Maryland Realtors Housing Statistics. This shows an

increase of $12,942 compared to the January 2023 average price of $419,587. The data shows sellers are beginning to list their homes at slightly higher prices. The sellers market over the past two years caused homes to have a dramatic overall increase in fair market value. In today's market, sellers are simply pricing their home at fair market value and seeing major profits in comparison to a couple of years ago.

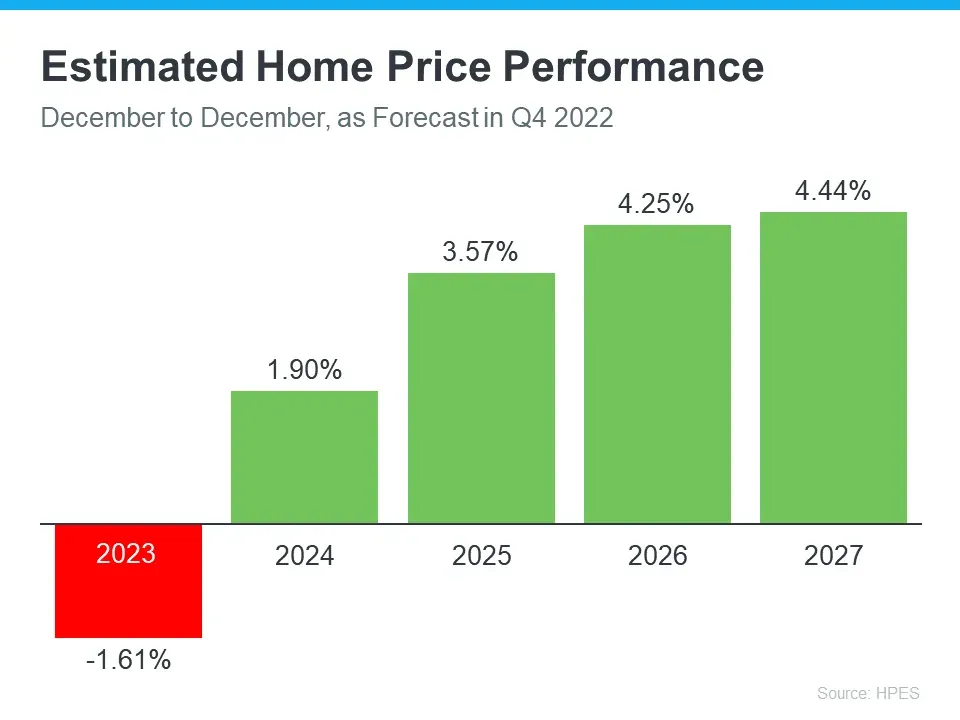

What’s Ahead For Home Prices in 2023

Over the past year, home prices have been a widely debated topic. Some have said we’ll see a massive drop in prices and that this could be a repeat of 2008 – which hasn’t happened. Others have forecasted a real estate market that could see slight appreciation or depreciation depending on the area of the country. And as we get closer to the spring real estate market, experts are continuing to forecast what they believe will happen with home prices this year and beyond.

Selma Hepp, Chief Economist at CoreLogic, says:

“While 2023 kicked off on a more optimistic note for the U.S. housing market, recent mortgage rate volatility highlights how much uncertainty remains. Nevertheless, the continued shortage of for-sale homes is likely to keep price declines modest, which are projected to top out at 3% peak to trough.”

Additionally, every quarter, Pulsenomics surveys a panel of over 100 economists, investment strategists, and housing market analysts regarding their five-year expectations for future home prices in the United States. Here’s what they said most recently:

So, given this information and what experts are saying about home prices, the question you might be asking is: should I buy a home this spring? Here are three reasons you should consider making a move:

- Buying a home helps you escape the cycle of rising rents. Over the past several decades, the median price of rent has risen consistently. The bottom line is, rent is going up.

- Homeownership is a hedge against inflation. A key advantage of homeownership is that it’s one of the best hedges against inflation. When you buy a home with a fixed-rate mortgage, you secure your housing payment, so it won’t go up like it would if you rent.

- Homeownership is a powerful wealth-building tool. The average net worth of a homeowner is $255,000 compared to $6,300 for a renter.

Experts are projecting slight price depreciation in the housing market this year, followed by steady appreciation. Given that, you may be wondering if you should move ahead with buying a home this spring. The decision to purchase a home is best made when you do it knowing all the facts and have an expert on your side.

Bottom Line

Let’s connect so you can make the most informed decision about your next move.

January 2023 Data