Maryland Market Report

Comparing Maryland Housing Market Trends

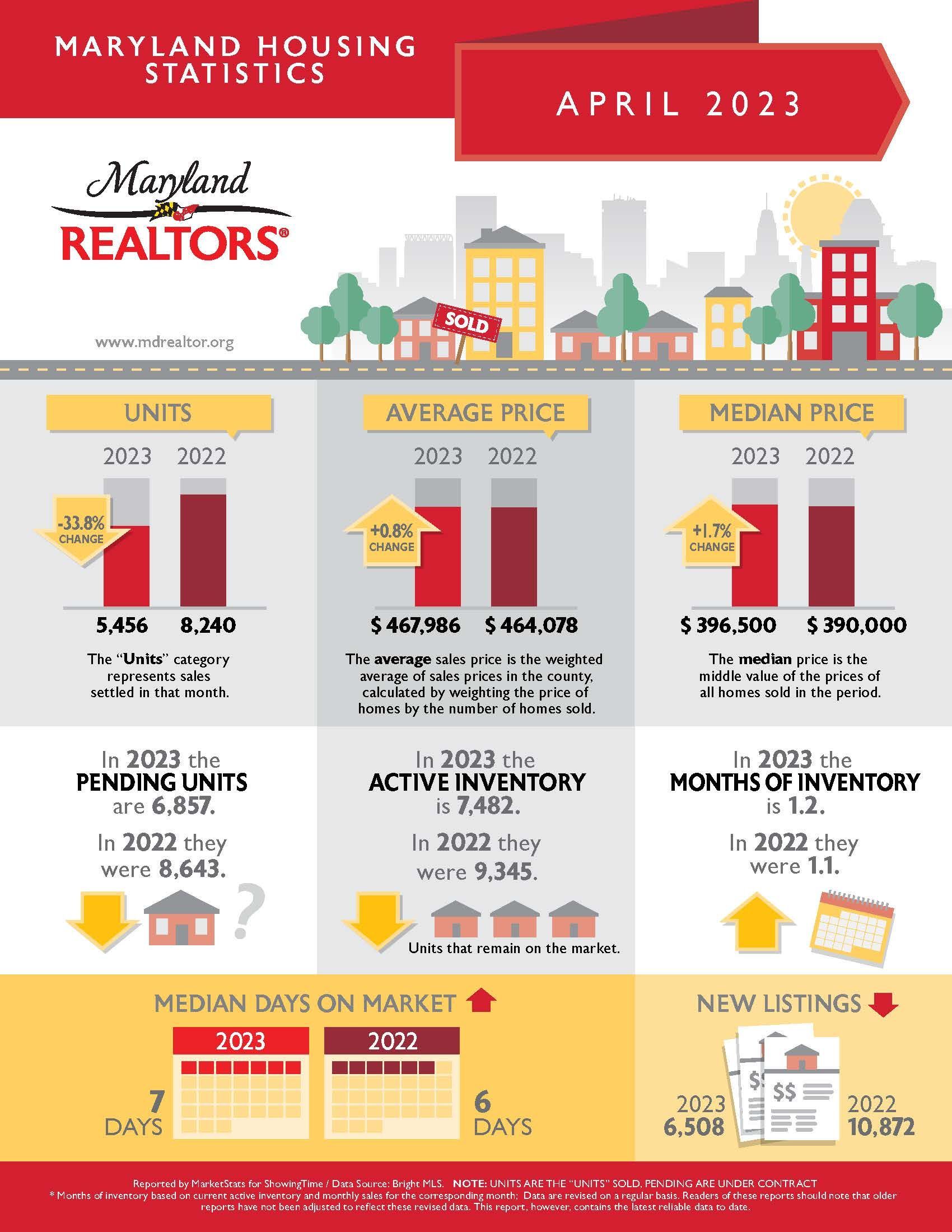

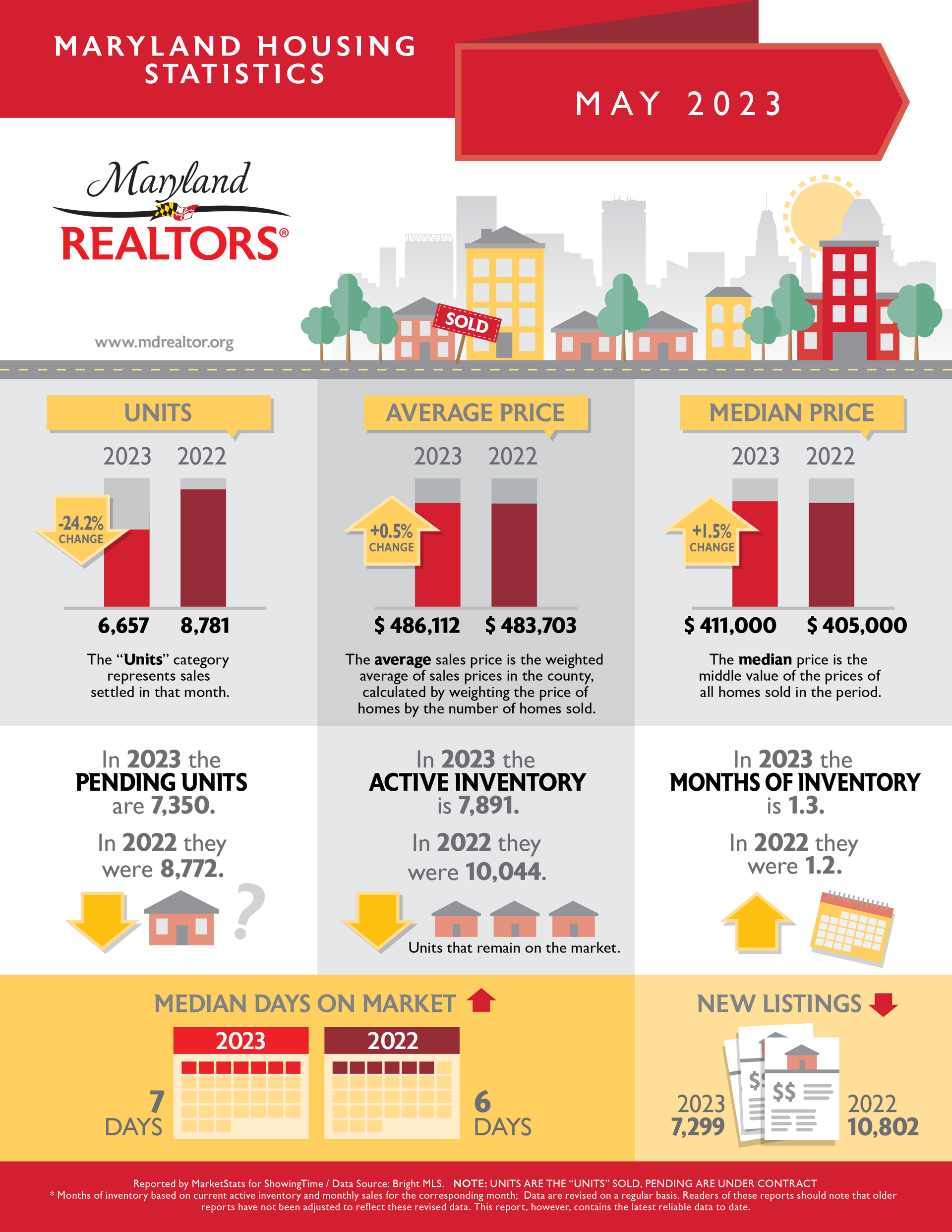

Units Sold

The spring/summer real estate market is in full swing! According to the Maryland Realtors Housing Statistics, there were 6,657 residential and commercial units sold in May 2023. This shows an increase of 1,201 units sold compared to April of this year.

This data also shows a decrease of about 24%, 2,124 units, compared to the number of units sold in April 2022.

Months of Inventory & Median Days On Market

According to

Maryland Realtors Housing Statistics, there’s currently 1.3 month’s worth of available MD housing inventory.

This shows a ten percent increase in the amount of Maryland’s housing market inventory from April of this year.

This data tells us the homeowners who’ve been preparing to sell in late winter and early spring are continuing to put their homes on the market and attracting buyers who’re looking for more inventory.

Also, based on the

Maryland Realtors Housing Statistics data, the

median number of days homes are sitting on the market has remained at seven days since last month.

This data tells us buyers are still moving quickly with submitting offers on available homes for sale. Additionally, many sellers are currently winning this spring by listing their home for fair market value and receiving multiple offers to choose from. If you are considering listing your home soon, let’s connect to discuss the fair market value.

Average Price

The average price of a Maryland home in May 2023 was $486,112; stated by the latest

Maryland Realtors Housing Statistics.

This shows an increase of $18,126 compared to the April 2023 average price of $467,986. The data shows Maryland sellers are continuing to list their homes at slightly higher prices. The sellers market over the past 2-3 years caused homes to have a dramatic overall increase in fair market value. In today's market, sellers are pricing their home at fair market value and seeing major profits in comparison to a couple of years ago.

Are Home Prices Going Up or Down? That Depends…

Media coverage about what’s happening with home prices can be confusing. A large part of that is due to the type of data being used and what they’re choosing to draw attention to. For home prices, there are two different methods used to compare home prices over different time periods: year-over-year (Y-O-Y) and month-over-month (M-O-M). Here's an explanation of each.

Year-over-Year (Y-O-Y):

- This comparison measures the change in home prices from the same month or quarter in the previous year. For example, if you're comparing Y-O-Y home prices for April 2023, you would compare them to the home prices for April 2022.

- Y-O-Y comparisons focus on changes over a one-year period, providing a more comprehensive view of long-term trends. They are usually useful for evaluating annual growth rates and determining if the market is generally appreciating or depreciating.

Month-over-Month (M-O-M):

- This comparison measures the change in home prices from one month to the next. For instance, if you're comparing M-O-M home prices for April 2023, you would compare them to the home prices for March 2023.

- Meanwhile, M-O-M comparisons analyze changes within a single month, giving a more immediate snapshot of short-term movements and price fluctuations. They are often used to track immediate shifts in demand and supply, seasonal trends, or the impact of specific events on the housing market.

The key difference between Y-O-Y and M-O-M comparisons lies in the time frame being assessed. Both approaches have their own merits and serve different purposes depending on the specific analysis required.

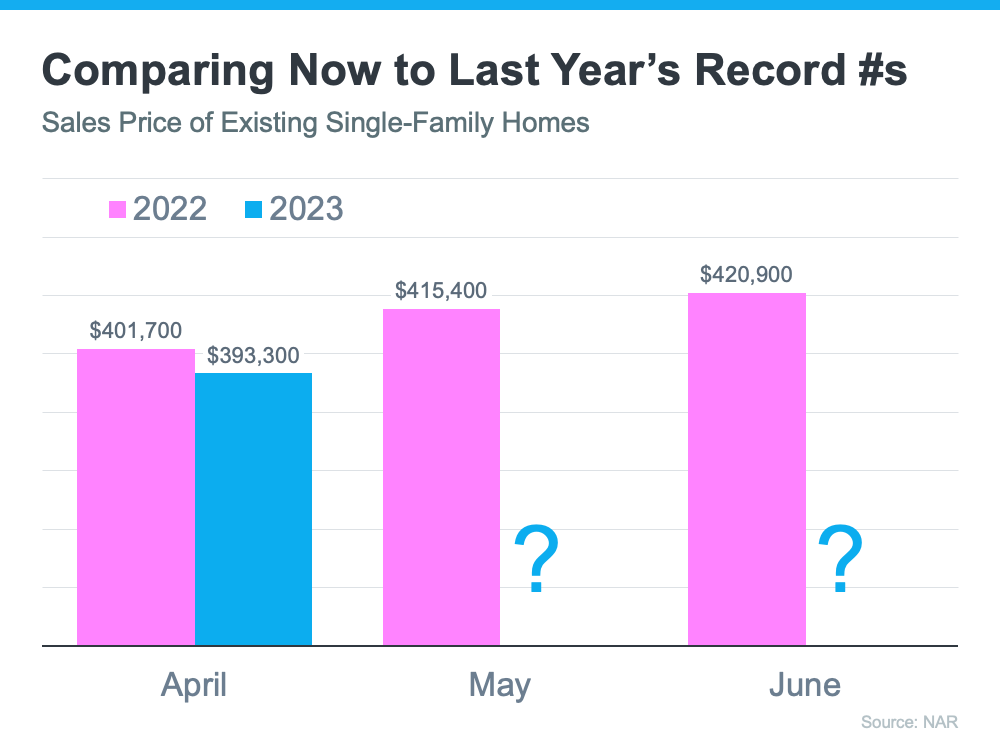

Why Is This Distinction So Important Right Now?

We’re about to enter a few months when home prices could possibly be lower than they were the same month last year. April, May, and June of 2022 were three of the best months for home prices in the history of the American housing market. Those same months this year might not measure up. That means, the Y-O-Y comparison will probably show values are depreciating. The numbers for April seem to suggest that’s what we’ll see in the months ahead (see graph below):

That’ll generate troubling headlines that say home values are falling. That’ll be accurate on a Y-O-Y basis. And, those headlines will lead many consumers to believe that home values are currently cascading downward.

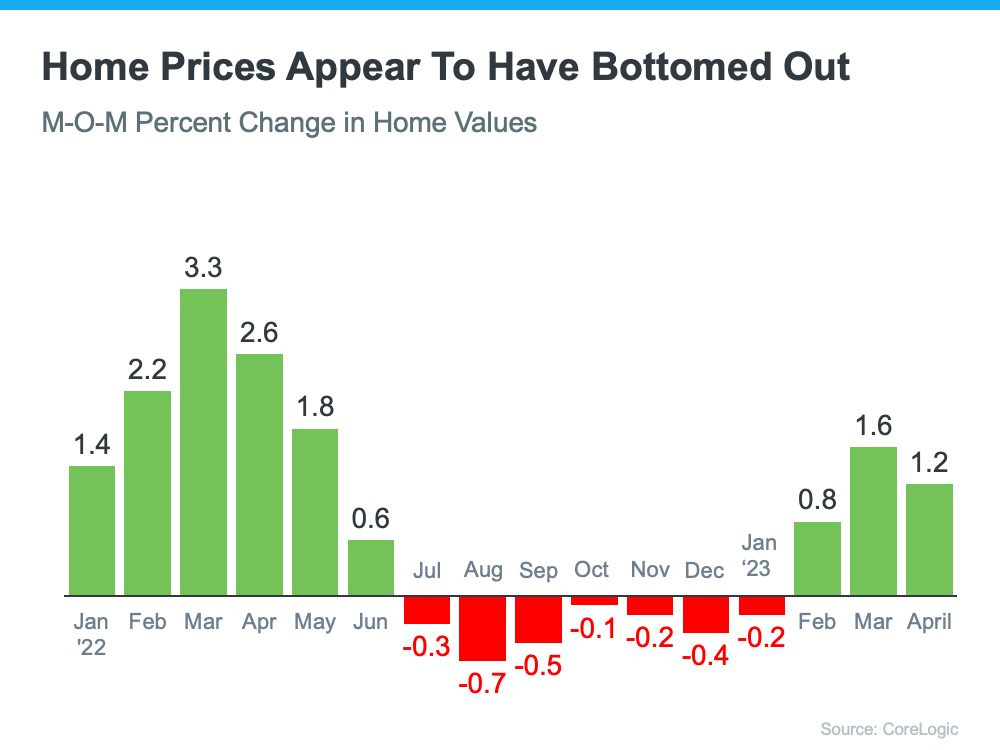

However, on a closer look at M-O-M home prices, we can see prices have actually been appreciating for the last several months. Those M-O-M numbers more accurately reflect what’s truly happening with home values: after several months of depreciation, it appears we’ve hit bottom and are bouncing back.

Here’s an example of M-O-M home price movements for the last 16 months from the CoreLogic Home Price Insights report (see graph below):

Why Does This Matter to You?

So, if you’re hearing negative headlines about home prices, remember they may not be painting the full picture. For the next few months, we’ll be comparing prices to last year’s record peak, and that may make the Y-O-Y comparison feel more negative. But, if we look at the more immediate, M-O-M trends, we can see home prices are actually on the way back up.

There’s an advantage to buying a home now. You’ll buy at a discount from last year’s price and before prices start to pick up even more momentum. It’s called “buying at the bottom,” and that’s a good thing.

Bottom Line

If you have questions about what’s happening with home prices, or if you’re ready to buy before prices climb higher, let’s connect.

April 2023 Data