Maryland Market Report

Comparing Maryland Housing Market Trends

Units Sold

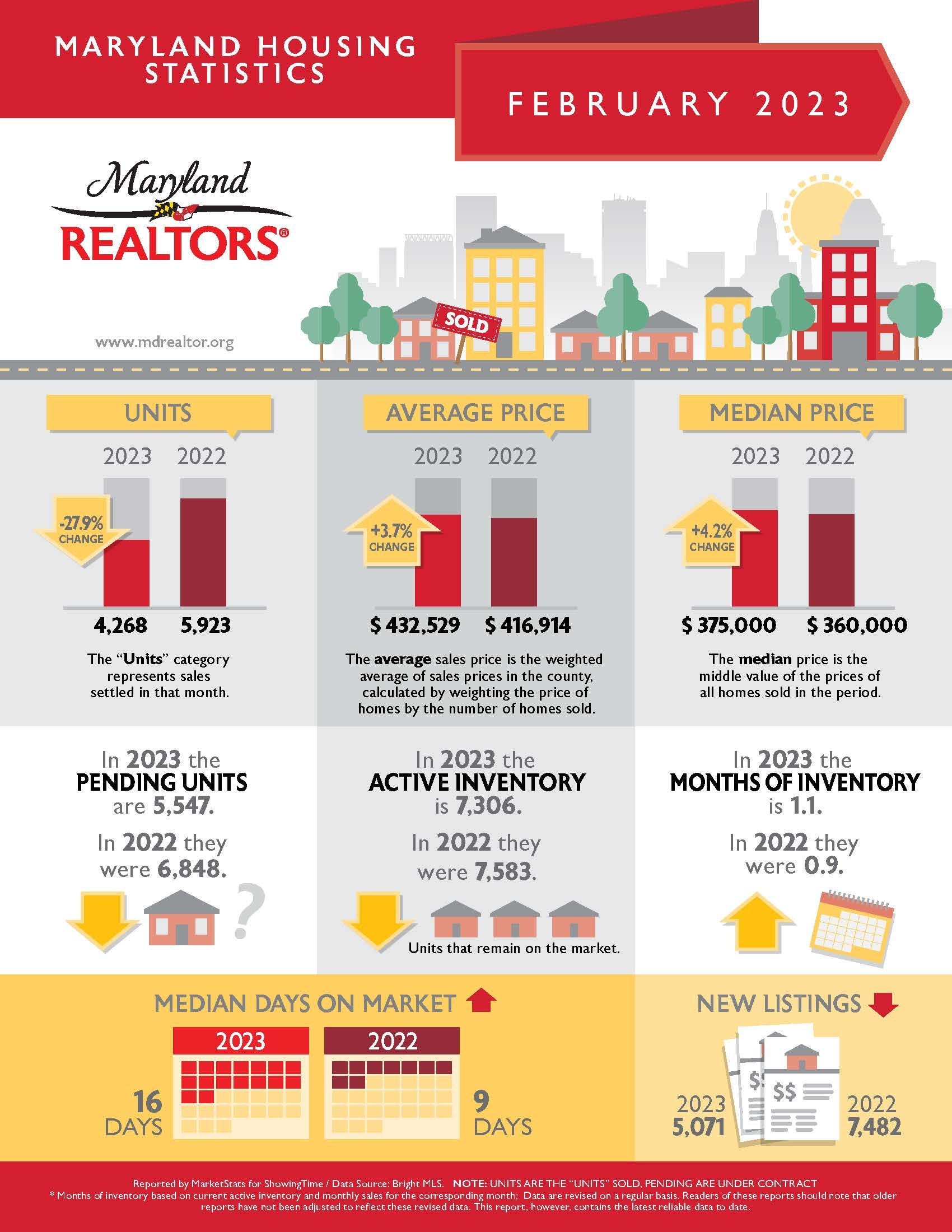

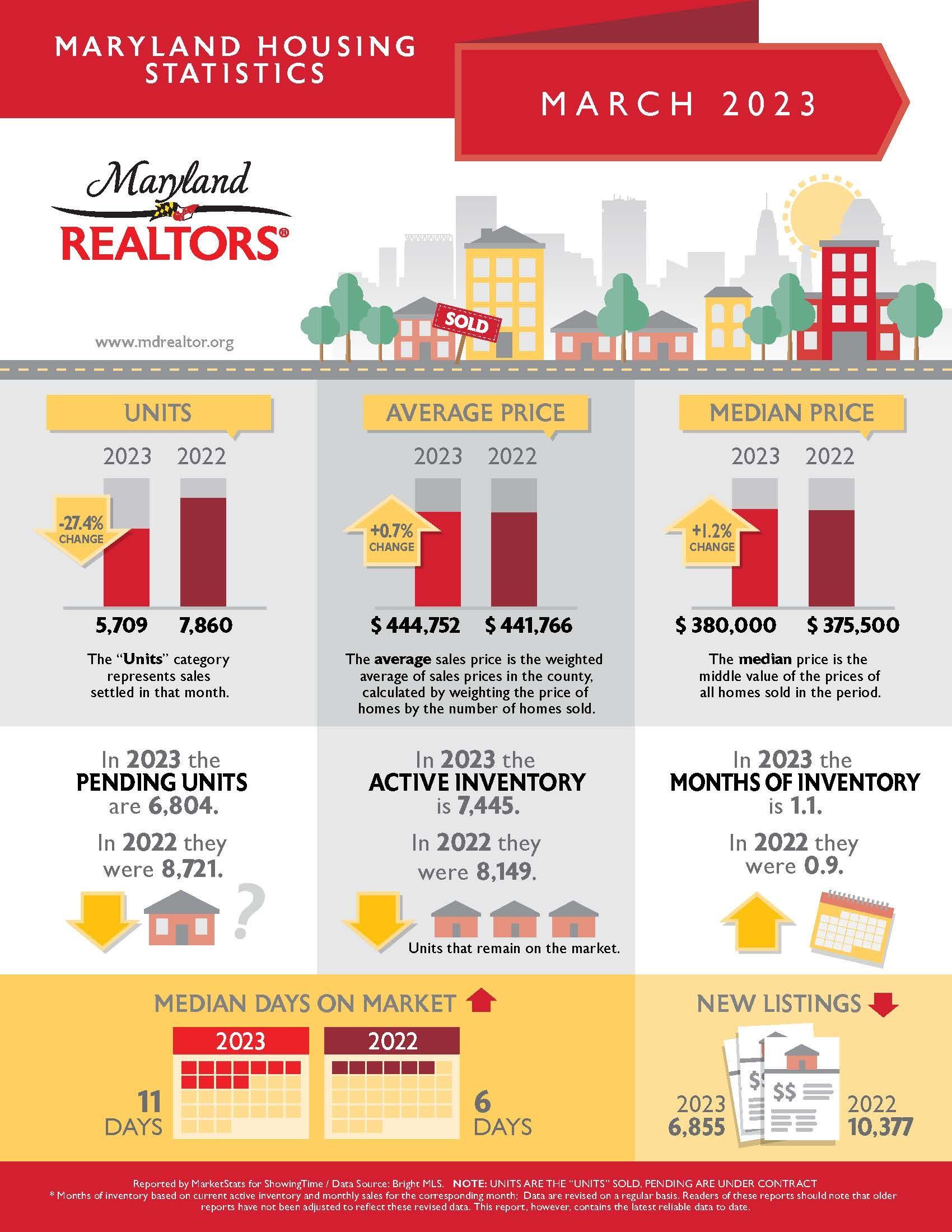

The spring real estate market is officially in full swing! According to the Maryland Realtors Housing Statistics, there were 5,709 residential and commercial units sold in March 2023. This shows an increase of 1,441 units sold compared to February 2023.

This data also shows a decrease of about 27%, 2,154 units, compared to the number of units sold in March 2022. Even though this is a noticeable difference compared to last year; it’s understandable considering the effects of the ups and downs of nationwide inflation and mortgage rates. With the economy stabilizing, more buyers are re-entering the market this spring. Realtor.com has the latest:

“Spring is officially here, and like green shoots emerging from the bleak winter, new data suggests that more buyers are back in the market, although more subdued compared to a year ago.”

If you’re planning to buy a home this season, this is the perfect time to get pre-approved and begin searching. If you’re planning to sell your home this season, this is the perfect time to get it on the market. Buyers are coming this spring, which is typically the busiest time of the year in real estate. And as Realtor.com tells us, if you’re a seller, you need to prepare:

“If homeowners are planning to sell in 2023, now is the time to get ready.”

This means working with a local real estate agent to maximize your home’s appeal and get it listed at the ideal price for your area.

Bottom Line

The housing market is warming up for spring. If you’re thinking about selling your house and taking advantage of this recent uptick in buyer activity, let’s connect.

Months of Inventory & Median Days On Market

According to

Maryland Realtors Housing Statistics, there’s currently 1.1 month’s worth of available MD housing inventory.

The amount of Maryland’s housing market inventory has remained the same from January to March of this year. This means the buyers who closed on homes within the last month have either moved quickly with new homes listed on the market or choose from existing inventory. Based on the

Maryland Realtors Housing Statistics

data, the

median number of days homes are sitting on the market has shortened from sixteen to eleven since last month.

This current data also shows a 20% increase from the 0.9 month’s worth of MD housing inventory in March 2022. Proving the housing market is slowly but surely continuing to stabilize from the effects of the COVID-19 pandemic.

According

to the latest Monthly Housing Market Trends Report from realtor.com:

https://www.realtor.com/research/january-2023-data/

https://www.realtor.com/research/january-2023-data/

https://www.realtor.com/research/january-2023-data

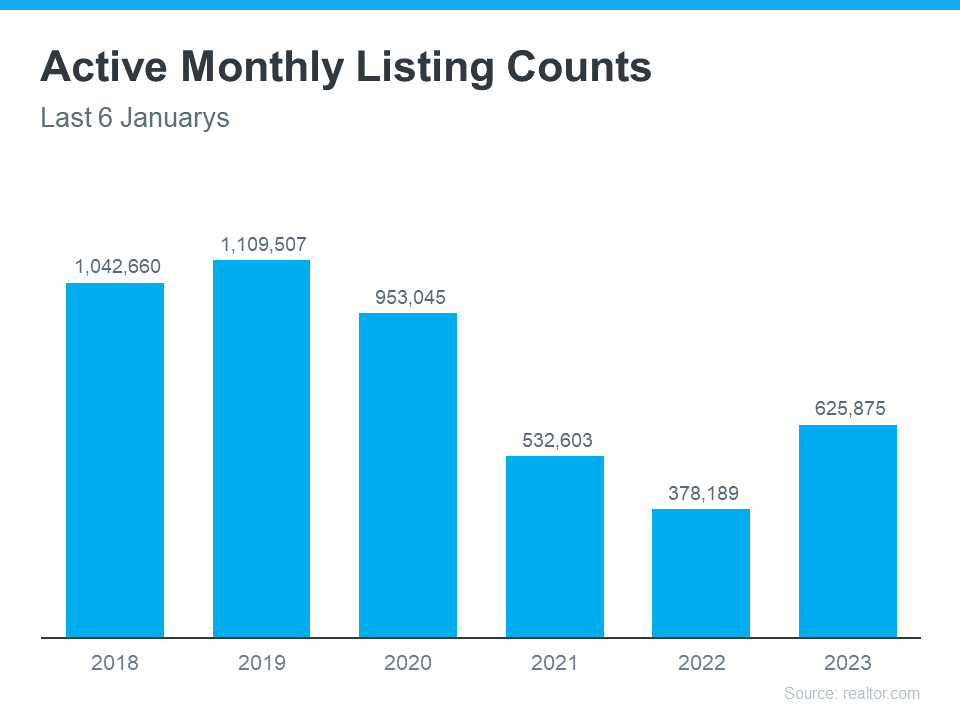

“There were 65.5% more homes for sale in January compared to the same time in 2022. This means that there were 248,000 more homes available to buy this past month compared to one year ago. While the number of homes for sale is increasing, it is still 43.2% lower than it was before the pandemic in 2017 to 2019. This means that there are still fewer homes available to buy on a typical day than there were a few years ago.”

The graph below shows how today’s national inventory of homes for sale compares to recent years:

Average Price

The average price of a Maryland home in February 2023 was $444,752; stated by the latest

Maryland Realtors Housing Statistics.

This shows an increase of $12,223 compared to the February 2023 average price of $432,529. The data shows sellers are beginning to list their homes at slightly higher prices. The sellers market over the past two years caused homes to have a dramatic overall increase in fair market value. In today's market, sellers are simply pricing their home at fair market value and seeing major profits in comparison to a couple of years ago.

Think Twice Before Waiting for Lower Home Prices

As the housing market continues to change, you may be wondering where it’ll go from here. One factor you’re probably thinking about is home prices, which have come down a bit since they peaked last June. And you’ve likely heard something in the news or on social media about a price crash on the horizon. As a result, you may be holding off on buying a home until prices drop significantly. But that’s not the best strategy.

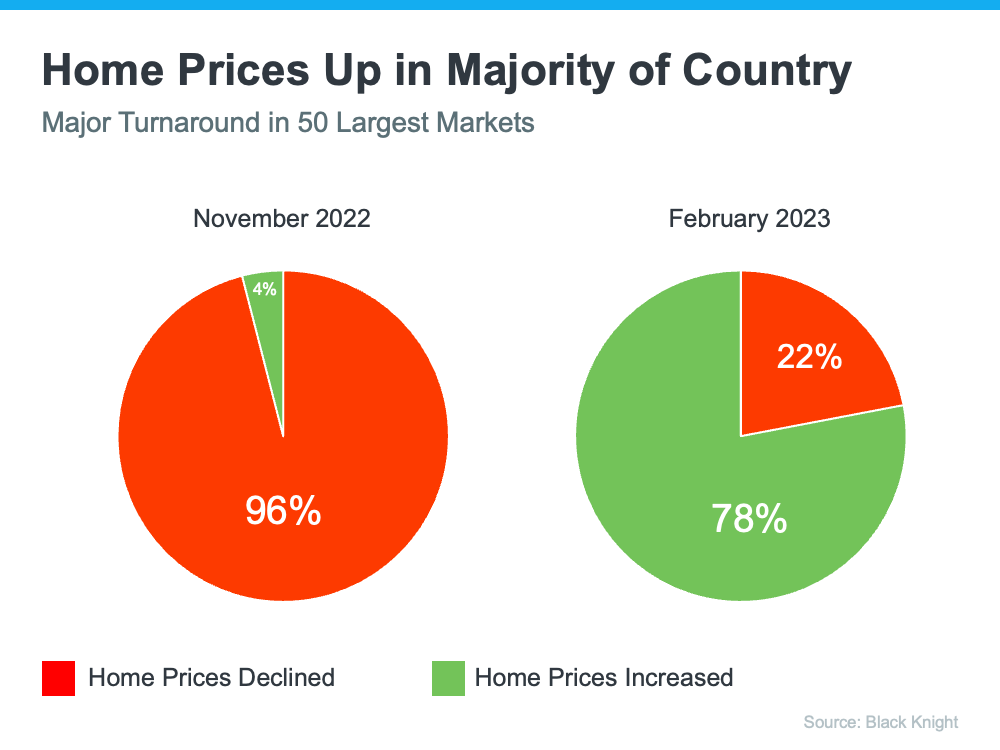

A recent survey from Zonda shows 53% of millennials are still renting right now because they’re waiting for home prices to come down. But here’s the thing: the most recent data shows that home prices appear to have bottomed out and are now on the rise again. Selma Hepp, Chief Economist at CoreLogic, reports:

“U.S. home prices rose by 0.8% in February . . . indicating that prices in most markets have already bottomed out.”

And the latest data from Black Knight shows the same shift. The graph below compares home price trends in November to those in February:

So, should you keep waiting to buy a home until prices come down? If you factor in what the experts are saying, you probably shouldn’t. The data shows prices are increasing in much of the country, not decreasing. And the latest data from the Home Price Expectation Survey indicates that experts project home prices will rise steadily and return to more normal levels of appreciation after 2023. The best way to understand what home values are doing in your area is to work with a local real estate professional who can give you the latest insights and expert advice.

Bottom Line

If you’re waiting to buy a home until prices come down, you may want to reconsider. Let’s connect to make sure you understand what’s happening in our local housing market.

February 2023 Data